How to get a tax refund on your online purchases from Decathlon?

Get a tax refund on your online purchases! To do so, simply have your order delivered to an address in France, Belgium, or Spain. On Decathlon, be sure to update the billing address to Zapptax. Here’s how:

Before completing your purchase, set Zapptax as your billing address.

Currently, the Decathlon website is not available in English. Here is the procedure with French captions.

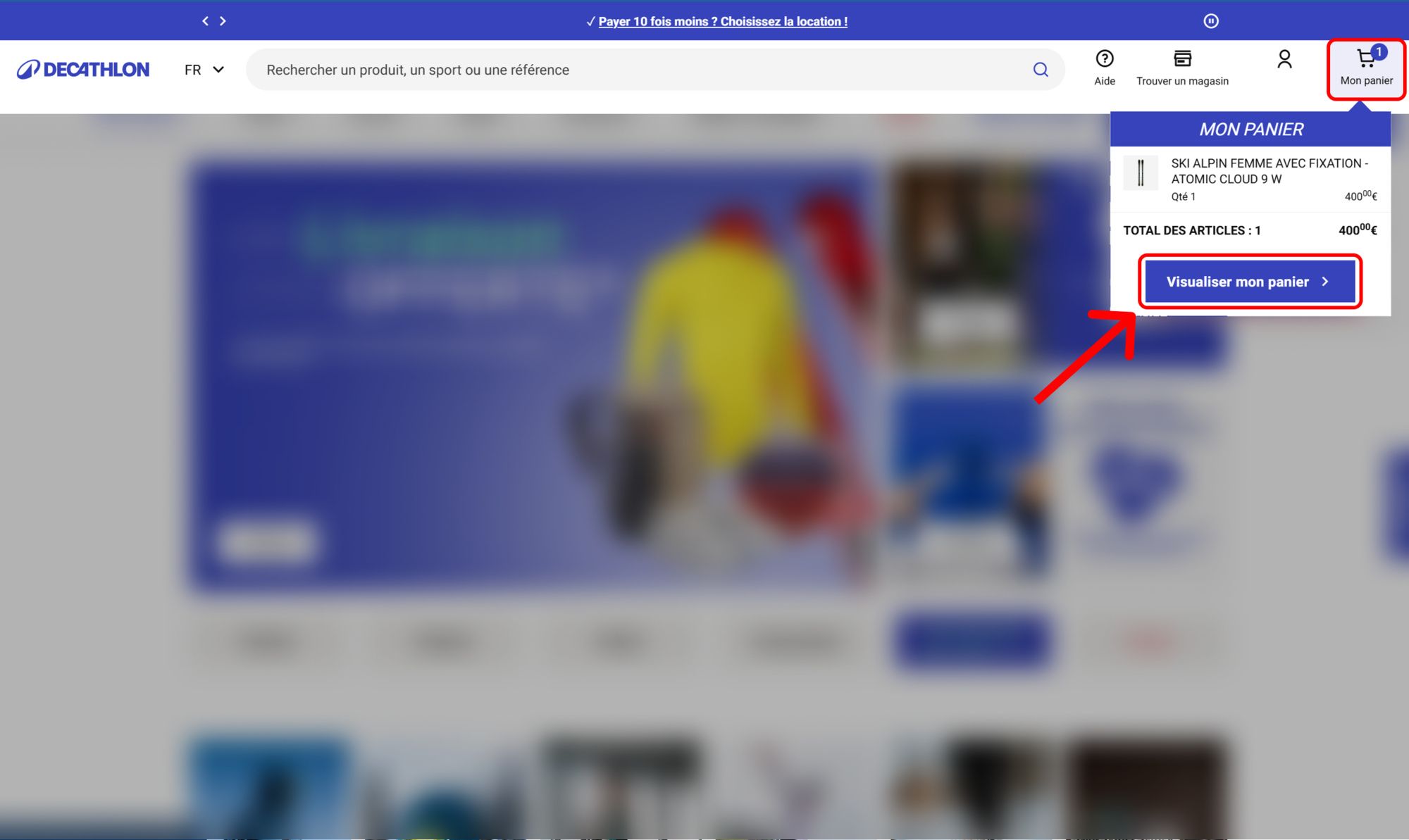

Step 1: On the main page, go to the My Cart section (top right) and click on View my cart.

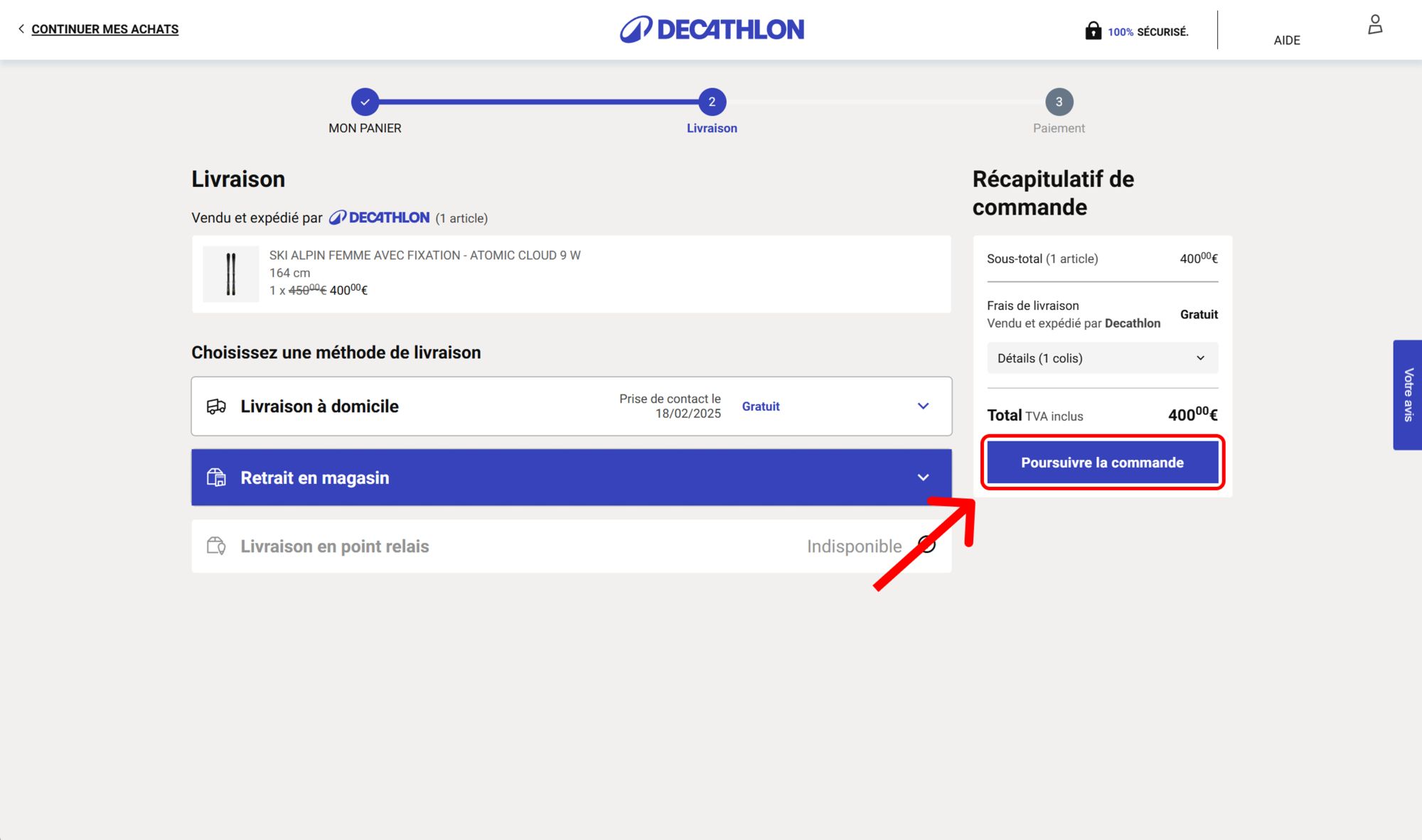

Step 2: Check your cart and click Proceed to checkout.

Select your preferred delivery method and click Proceed to checkout again.

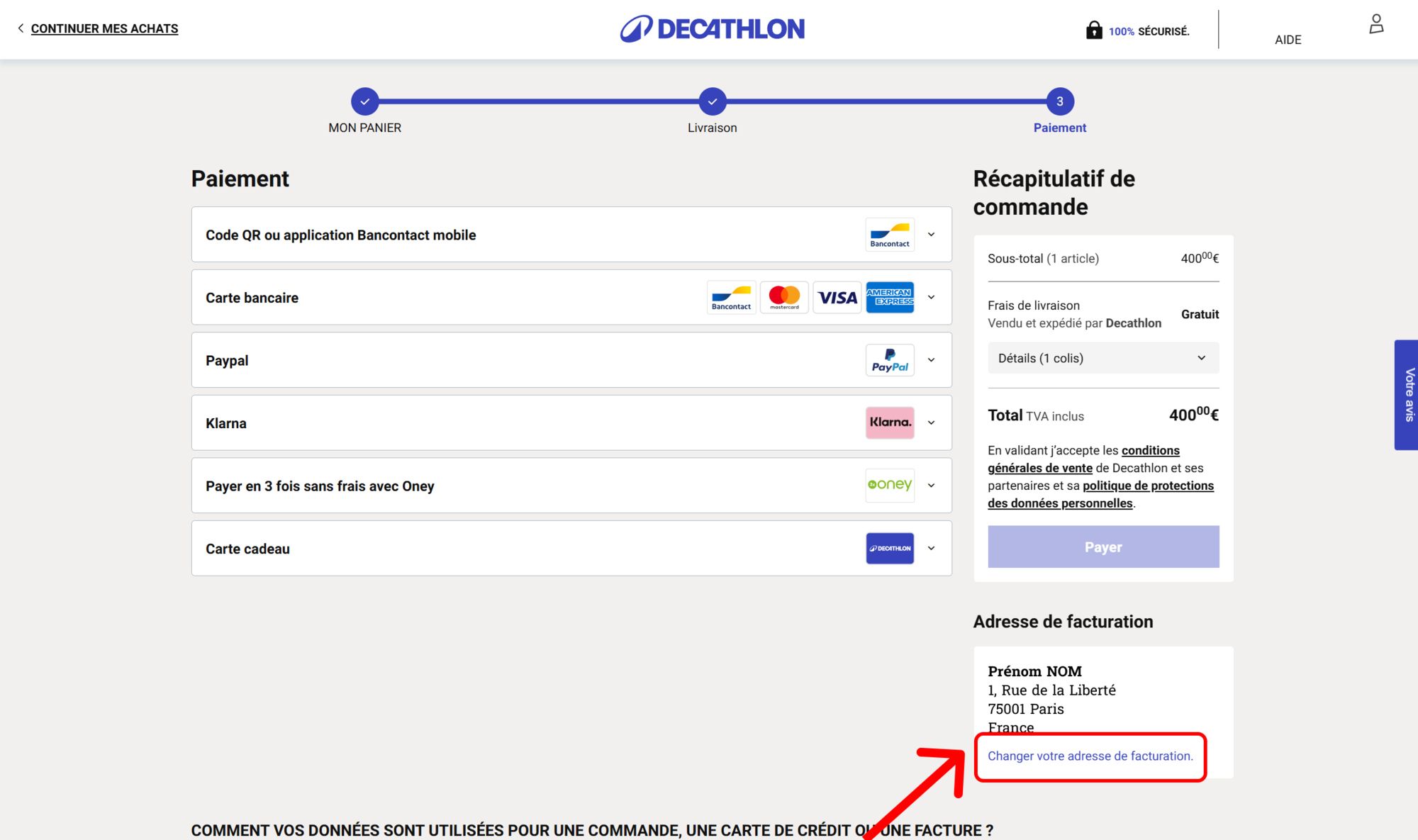

Step 3: Choose your payment method, then at the bottom right of the screen, click Change billing address.

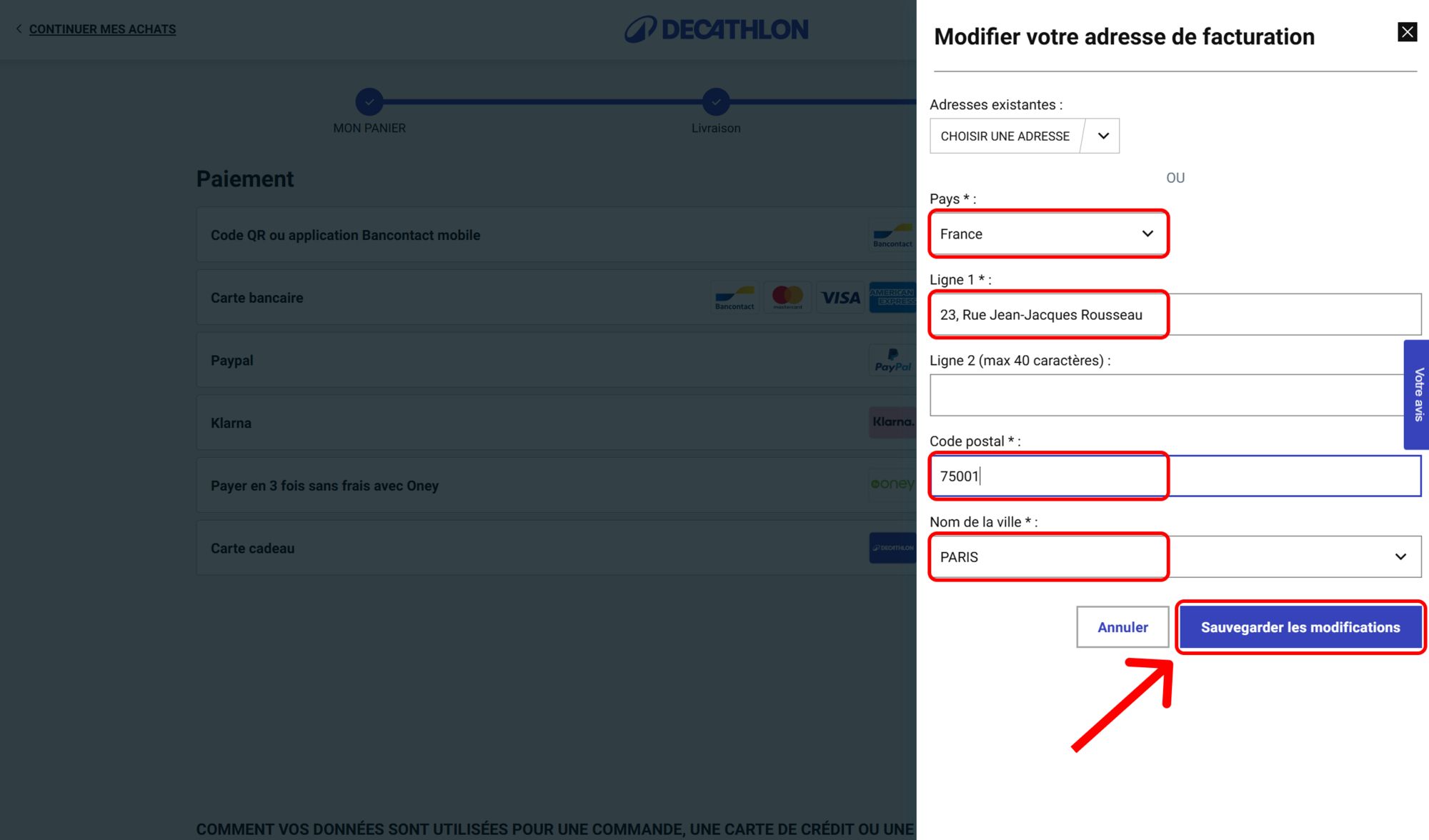

Step 4: Add a new billing address and fill in the required fields with Zapptax’s address:

- France: Zapptax - 23, rue Jean-Jacques Rousseau, 75001 Paris

- Belgium: Zapptax - Rue du Boulet 42, 1000 Brussels - VAT number: 0670 776 774

- Spain: Zapptax - Bravo Murillo, 52 1-3, 28003 Madrid - VAT number: N0173919B

Click Save changes.

Now you're all set to claim your tax refund with Zapptax 🙂

How to retrieve your invoice after placing your order?

If you have already added Zapptax’s details to your Decathlon account and completed your purchase but cannot find your invoice, follow these steps:

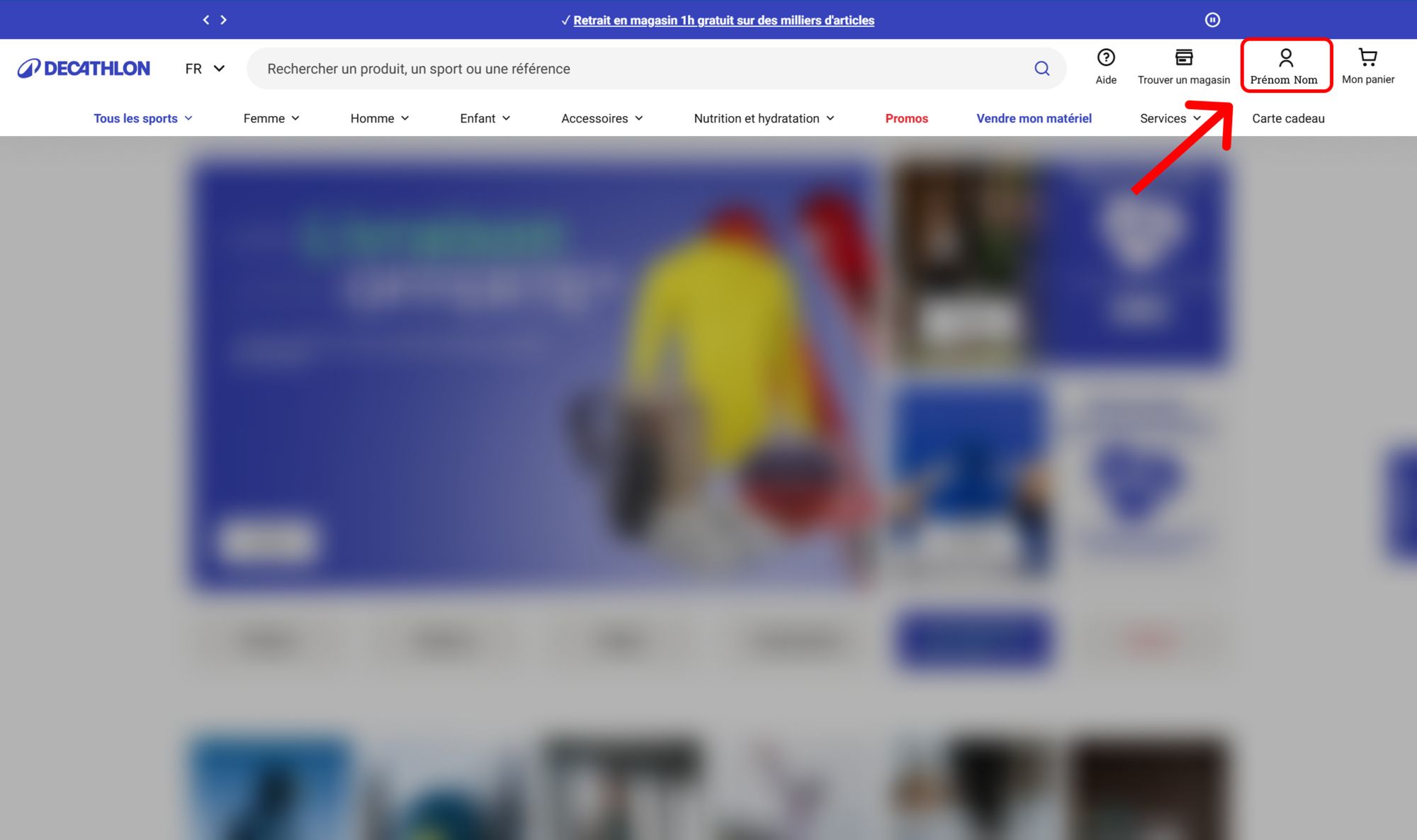

Step 1: Go to Your Account (your first and last name) at the top right of the main page.

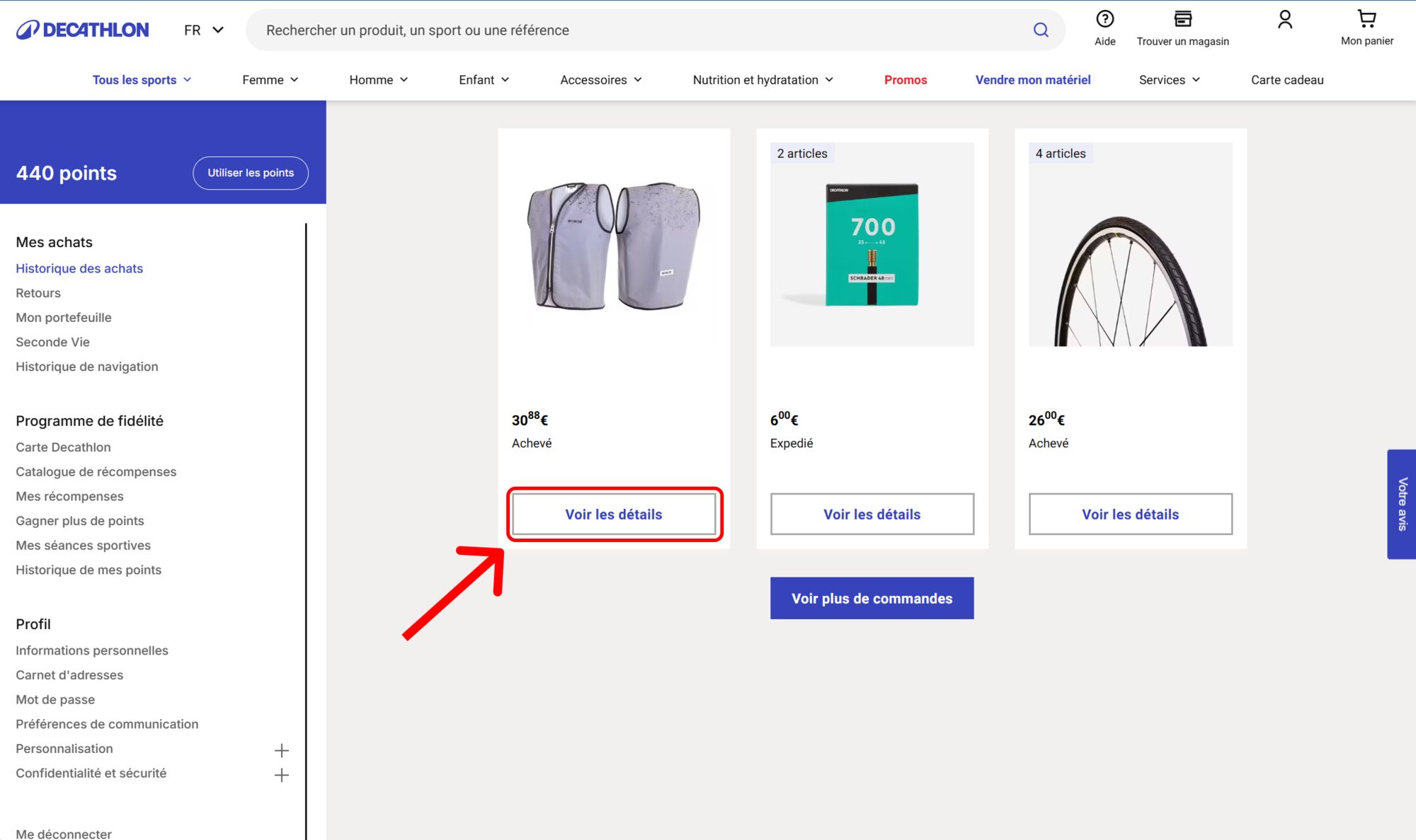

Step 2: Click on My Orders, then select the relevant order and click View details.

Step 3: Click on Download invoice.

That’s it! Now simply upload your invoice to the Zapptax app.

With Zapptax, reclaiming VAT on your purchases in France, Belgium, and Spain has never been easier. Thanks to its user-friendly app, turn your online shopping into extra savings—hassle-free. Manage your tax refund effortlessly and receive your refund quickly via bank transfer or PayPal.