You’ve just made some purchases in France and are counting on getting your VAT refund. But one question keeps popping up: when will I receive my refund? Between customs validation, refund forms, and intermediaries... delays can seem unclear—or even very long.

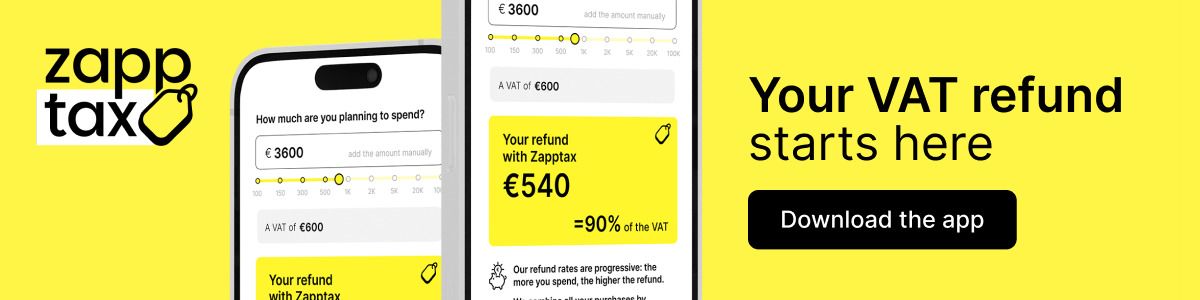

In this article, we explain the exact workings of the tax refund process: what steps to follow, how long to wait before seeing the money hit your account, why time frames vary from one tax refund provider to another, and most importantly, how Zapptax simplifies the process while ensuring a secure refund.

In just a few minutes of reading, you’ll know how to avoid the most common mistakes, anticipate real-life timelines, and take advantage of a more transparent and user-friendly tax refund system.

Let’s start with a quick recap of the key take-aways regarding your refund with Zapptax plus the eligibility criteria before diving into the details.

Discover the complete guide to getting your VAT refund in France in 2025.

The 5 take-aways regarding your VAT refund with Zapptax:

- Your tax free form must be validated electronically via a PABLO kiosk or stamped by a Customs officer before you leave the European Union.

- With Zapptax, the refund is 100% guaranteed once the form is validated—no hidden fees.

- Once validated, the refund is triggered automatically.

- The refund time frame depends on the processing speed of the tax administration: from a few days to 6 weeks or sometimes even slightly longer.

- Peak processing periods (summer, holidays) can extend this time frame by several weeks.

What are the conditions to be eligible for a VAT refund?

To be eligible for a VAT refund, the following conditions apply:

- Be over 16 years old.

- Reside outside the European Union.

- Stay in the EU for less than 6 months.

- Carry the goods in your personal luggage and keep them unused until Customs validation.

Eligible items include physical goods purchased in-store or online: clothing, wine, leather goods, perfumes, electronics, souvenirs…

Be aware: VAT on services like meals, transportation, accommodation (hotels, AIRBnB) or on goods that have already been consumed is non-refundable.

Now before we get into the details regarding refund time frames, if you want to know more about tax free shopping in general and about tax refunds with Zapptax, please take a look at our complete guide to getting your VAT refund in France in 2025.

What is the VAT refund time frame in France?

Once your tax-free form is validated by Customs (via an electronic PABLO kiosk or a Customs officer), your refund is indeed triggered—there’s nothing more for you to do.

However, the VAT refund doesn’t happen instantly. Why? Because two separate administrations are involved in the process:

-

French Customs, which confirm the goods have exited the EU by validating your tax-free form (this is your proof of export).

-

The tax administration, which alone is authorized to return the VAT once the export is confirmed.

The validation of your tax refund form triggers a sequence of administrative steps until the funds are transferred to your account.

Here’s how it works behind the scenes.

1. Validation of the refund form: proof of export

Electronic validation of the tax-free form (via a PABLO kiosk or Customs officer) serves as official proof that the goods have left the European Union. Without this validation, no refund can be initiated—regardless of the platform or merchant involved.

2. Declaration to the tax administration

The tax refund operator, the buyer-reseller (like Zapptax) or, in some cases, the merchant, submits a monthly VAT declaration to the French tax authorities. This declaration includes all validated forms for the relevant period.

3. Processing time by tax authorities

The processing of this declaration depends on local tax offices, based registration location of the intermediary that submit the request (1st arrondissement of Paris, Strasbourg, etc.). Processing times vary by region and time of year. It can take from a few days to several weeks—or more during peak periods.

4. Refund to the traveler

Once the funds are received from the tax administration, the intermediary proceeds with the refund. If all eligibility conditions are met and the form has been validated, the refund is guaranteed. With Zapptax, this transfer typically happens a few days or a few weeks after the funds are received.

Why do some tax refund providers offer immediate cash refunds at the airport or relatively faster refunds on credit cards?

Some tax refund intermediaries offer travelers immediate cash refunds at counters located in international airports right after their tax-free form is validated. Others provide relatively faster refunds (within a couple of days or weeks) through credit cards. These services may seem appealing and convenient, but they hide several lesser-known realities.

1. A system based on bank pre-financing

Tax refund operators that offer instant or faster refunds generally are large international corporations. Their model relies on pre-financing VAT: they pay the money to travelers upfront before collecting the VAT from the tax authorities.

This prefinancing is made possible by massive bank loans or credit lines (at a steep cost). These are industrial-scale, standardized and globalized tax refund machines—often disconnected from local ecosystems.

2. An "instant" cash refund or “faster” electronic refund… but less advantageous

Instant or faster refunds are not without drawbacks. In most cases, travelers receive an amount significantly lower than what they’re actually entitled to:

-

Reduced refund rate compared to the actual VAT paid

-

Often high, non-transparent commissions

-

Unfavorable exchange rate if refund is made in another currency

-

Extra queue at the airport, in a stressful context (luggage, flight times, crowd...)

This type of refund is designed to be faster... but often at the expense of the refund amount.

3. Zapptax: a local, stable, and transparent model

Zapptax has chosen a different model, centered on the traveler’s best interest:

-

A locally managed service (France, Belgium, Spain), with no bank pre-financing

-

A guaranteed refund once the form is validated by customs

-

No hidden fees, no currency manipulation

-

An optimized refund rate, among the highest in the market

This model results in slightly longer and fluctuating refund time frames – typically a few weeks – as it depends on how long the tax authorities take to process our requests and release the funds. Tax authorities have their own operational constraints—such as holidays and peak periods—which can affect how quickly they handle requests.

A guaranteed refund after validation

As soon as a form is validated electronically via a PABLO kiosk—or a Customs-stamped version is uploaded in the Zapptax app—the refund is 100% guaranteed.

How to obtain a tax free form with Zapptax?

To simplify the tax refund procedure, it’s recommended to use a centralized and digital solution, such as the Zapptax app.

Here are the steps to follow:

- Download the Zapptax app on your smartphone (available on iOS and Android).

- For each in-store purchase, ask for an invoice in the name of Zapptax (the billing information is provided in the app).

- For online purchases, enter Zapptax’s billing details at checkout. Your order must be shipped to a country where Zapptax operates (France, Belgium, or Spain).

- Import each invoice into the app. The amounts are automatically tallied.

- Once your cumulative purchases exceed €100 (incl. VAT), you’re eligible for a VAT refund.

- At the end of your trip, generate your unique tax-free form, grouping all your invoices, directly in the app.

This method spares you the paperwork and lets you combine multiple purchases—even from different shops—on a single form.

When should you validate your tax-free form?

- Validation must be done on the day of your departure, at your point of exit from the European Union (in case of stopover within the EU, validation must be obtained at the point of exit where you checked in your bags).

- Your goods must be in your luggage at the time of validation.

- The form must be validated no later than the last day of the 3rd month after the purchase (e.g. purchase in April → validation before end of July).

Missing this deadline may lead to a refund refusal, unless you provide a valid justification to Customs.

How to validate your tax-free form?

1. With a PABLO kiosk:

- Scan the barcode of your tax-free form at a PABLO kiosk (available in most international airports, border crossings, ports, and land exits).

- The screen will display a green validation message if everything is correct. No need to visit the Customs desk.

- The refund is then automatically triggered (nothing more to send).

2. With Customs officers:

- If no Pablo kiosk is available, or your form was not issued in France, go to the Customs desk.

- Show your form, your ticket, your passport and the goods. A Customs officer will stamp the form.

- Take a photo of the stamped form and upload it to the Zapptax app to trigger the refund.

3. Where to find PABLO kiosks?

PABLO kiosks are mostly located in:

- International airports in France (Paris-Charles de Gaulle, Orly, Nice, Lyon, Marseille, Bordeaux, etc.)

- Train stations serving international trains (such as Paris Gare du Nord, Lyon-Part-Dieu, Marseille-Saint-Charles)

- Sea ports or border crossings used by travelers leaving the EU territory by see or land

In airports, kiosks are usually placed:

- Near customs desks or baggage drop areas

- In departure halls before security checks

The kiosks are usually clearly signposted under "Détaxe / VAT Refund".

Note:

- Validation must take place before checking in your luggage - and therefore also before passing through security.

- Have your items with you: a Customs officer may ask to see them.

How to track your VAT refund?

- The Zapptax app offers real-time tracking of your refund forms.

- You’ll receive email notifications at each stage.

- You can view your activity history at any time through the app.

This tracking system ensures greater transparency and helps you stay informed about the progress of your refund.

Conclusion

Understanding VAT refund time frames helps you plan your international purchases more efficiently. Thanks to tools like Zapptax, travelers can simplify the process, centralize their invoices, and speed up the handling of their request.

By meeting the conditions and deadlines, and validating your forms properly, you’re giving yourself the best shot at a reliable, guaranteed, and secure refund.

Key takeaway: a well-prepared tax refund means an easier reimbursement.

FAQ

-

What is the refund time frame for a VAT refund?

It strongly depends on the service provider, the traveler’s country of residence, and the volume of ongoing requests. On average, the refund is processed within 2 to 6 weeks after validation. However, peak travel seasons can extend this delay by several weeks.

-

How can I track my tax refund?

Most digital tax refund services, like Zapptax, allow you to monitor the status directly in the app. You’ll see updates such as: pending, validated, refunded. A refund confirmation (bank transfer or notification) marks the process as complete.

-

Where can I receive my VAT refund?

Refunds can be issued:

- By bank transfer or credit card, a few days to several weeks after validation. This is the safest and most traceable option.

- Via PayPal.

In all cases, the refund is never made by Customs, but by the intermediary or platform handling your request.

-

Why is the refund time frame variable?

The refund is only triggered after official validation of the form. Administrative processing time varies depending on the tax authorities involved. It is therefore not possible to guarantee a uniform timeline.

-

Can I get a refund if I lost my tax-free form before validation?

Unfortunately, without a validated form (electronic or stamped), it’s not possible to claim a VAT refund.

-

Can I process the tax refund online?

Yes, with solutions like Zapptax, you can handle the entire tax refund process online: uploading invoices, generating the refund form, tracking validation, and receiving your refund. This solution is ideal for both in-store and online purchases. You can group multiple invoices on a single form and benefit from personalized support.

-

How can I get my VAT refund at the airport?

Go to the Customs area before baggage drop-off or boarding, depending on the airport’s layout. Use a PABLO kiosk to validate your form if it is electronic. If no kiosk is available, present your items, passport, and form to a Customs officer. Once validated, your refund process is automatically triggered.

-

Can I get a VAT refund if I leave the EU from a country other than France?

Yes. You must have your tax-free form validated by Customs in the EU country through which you’re exiting. Make sure the document is stamped or electronically validated before leaving the EU.

If you shopped in France but are leaving from another EU country, you must print your tax-free form and have it manually stamped by a Customs officer (PABLO kiosks are only available in France), and then upload a photo of the stamped form to the app. Never drop your stamped paper form in an airport mailbox—even if a Customs officer suggests it.