VAT refund France 2026 – Step-by-step guide for non-EU residents

Are you planning a holiday in France ? Whether you’re drawn to the lavender fields of Provence, the elegance of Paris, or the sun-soaked charm of the Côte d’Azur, one thing is certain : France knows how to welcome its visitors.

Beyond the charm and cultural richness, your French getaway also comes with a practical bonus. One that many travellers don’t even realize exists. If you live outside the EU, you can claim back the Value Added Tax (VAT) on pretty much all your purchases before returning home.

In this article you will discover everything you need to know about VAT refund in France. What purchases can be VAT-refunded? As a tourist, can I claim a refund ?

It begins with the eligibility criteria, then the refund process, and also tips to ensure a smooth experience. At last, you will find our step-by-step guide that will walk you through the process to claim your tax refund.

Because saving money while enjoying French shopping sounds like a smart plan.

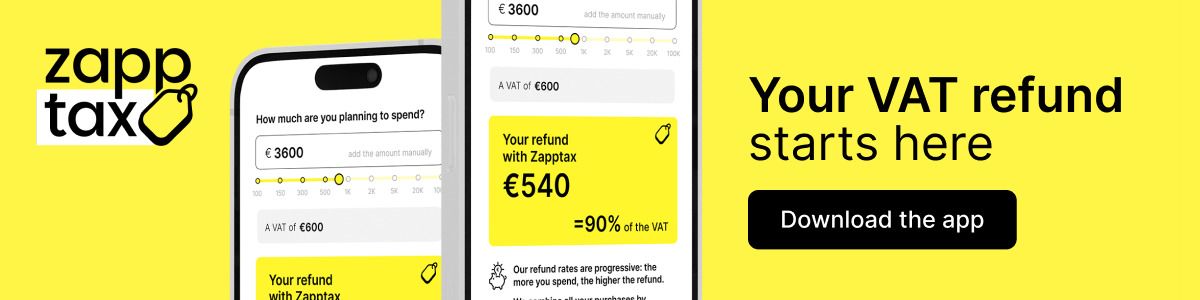

Get your VAT refund faster and easier with Zapptax, discover the app now.

Key points

-

Who qualifies : you must be a non-EU resident, 16+, and staying in France for less than 6 months.

-

Minimum spend : with Zapptax you can combine eligible purchases across different stores and different days to reach the €100 minimum threshold.

-

Purchases eligible : goods only (clothes, cosmetics, electronics, etc.). Services (restaurants, hotels, taxis) are not refundable, and goods must be new/unused.

-

Deadline : you must carry the goods with you outside the EU no later than the end of the 3rd month after purchase.

-

Customs validation is mandatory : validate at your last EU exit point (PABLO kiosk or with a Customs officer) before check-in and before security, with goods accessible.

-

How much you really get back : travelers can recover around 12% to 15% of the purchase price (VAT incl.)

What is VAT and what is the VAT rate in France?

VAT (literally “Value Added Tax”) is a consumption tax applied to goods and services in most countries around the world. In France, VAT is known as “TVA” (Taxe sur la Valeur Ajoutée), and it’s already included in the price tags you see in stores, restaurants, and service providers. That means when you buy something, you're automatically paying VAT, often without even realizing it. The standard tax is 20%, which applies to the majority of consumer goods (clothing, electronics, perfumes...) and services.

However, France also applies reduced VAT rates for certain categories:

- 10% for restaurant meals, hotel accommodations, transport services, and some cultural events.

- 5.5% for essential goods such as most food products, books, medical equipment for disabled persons, and energy-efficient home improvements.

- 2.1% an even lower rate used for newspapers and specific medications reimbursed by social security.

These rates are set at a national level and apply uniformly across the country, whether you’re shopping in Champs Elysées Paris, Marseille, or a small village in Corsica. For most travelers, the key point to remember is that you can claim a VAT refund on eligible purchases of goods (not services) if you're a resident outside the EU and meet certain conditions (we'll cover these below). Since the standard rate is 20%, that refund can amount to significant savings, especially on higher-end goods like designer fashion, electronics, or French wines and cosmetics.

Is the full VAT refunded to tourists in France ?

Not entirely, sorry.

While the standard VAT rate in France is 20%, you won't get a full refund of 20%.

First, a reminder of basic arithmetic—because there’s often some confusion. The 20% VAT rate applies to the price excluding VAT. For example, for an item with a pre-tax price of €100, a 20% VAT rate results in… €20 in VAT. The total price will therefore be €120.

But be careful: those €20 in VAT do not represent 20% of the VAT-included price of €120! They only represent 16.66% of the VAT-included price (that is, €20 divided by €120).

So, you can never recover 20% of the VAT-included amount. The maximum you could recover—if all the VAT were refunded—is 16.66%, or 20 €.

Besides, most tax refund providers deduct processing fees or commissions, which can reduce the amount you get back. In practice, your refund often ends up being between 10% and 15% of the purchase price, VAT included!.

The exact amount depends on how you choose to process your refund. Some services allow you to keep a larger share of the VAT by simplifying the process and reducing intermediary costs. For example, using a digital solution like Zapptax can help you to receive a higher refund compared to traditional methods (up to 90% of the VAT paid compared to 70%).

Want to know how much you can get back ? Try our VAT refund France calculator to estimate your tax-free savings.

Who is eligible for a VAT refund in France?

In order to get a VAT refund in France, make sure that you know the eligibility criteria. You should know that not everyone qualifies, but if you do, you will turn your shopping into real savings.

To claim a VAT refund in France, you must meet all of the following conditions:

1. You must live outside the European Union

The VAT refund is a benefit specifically offered to non-EU residents. That means if your official place of residence is outside of the European Union, you are eligible.

Tip: With Zapptax, there's no need to show your passport at every purchase, in every store. Instead, you only need to verify your identity once a year in the app using your passport. For most tourists, this is enough. But if you're an expatriate with an EU passport living outside the EU, you'll also need to upload a valid proof of non-EU residency, such as a residence certificate or visa.

2. You must be staying in France for less than six months

The refund is intended for short-term visitors, such as tourists, expats visiting family or business travelers. If you’re living in France temporarily but for more than six months, for example if you’re studying or working under a long-term visa, you can not be refunded.

Note: If exceeding the six-month stay in France is accidental or beyond your control, it does not change your status as a non-EU resident. As a result, you will still be eligible.

3. You must be at least 16 years old This rule applies across the EU and ensures that the VAT refund process is limited to adults or older teenagers who are responsible for their own purchases and travel documents.

4. In France, you must spend more than €100 With traditional VAT refund systems, the rule is strict: you must spend at least €100 (VAT incl.) in a single store, on the same day, because each store issues its own tax-free form.

With Zapptax*, it's different and far more flexible. Since the tax-free form is created at the end of your trip, all eligible purchases, across multiple stores and days, can be combined. This means you only need to reach a total of €100 (VAT incl.) for your entire stay, regardless of where and when you shop (as long as it’s within the same country).

Example: You buy a €40 cap on Monday, a €30 scarf on Tuesday, and a €35 T-shirt on Friday, all from different stores in France. Your total is €105, so you're eligible for a VAT refund with Zapptax.

5. The goods must be for personal use and exported outside the EU within three months

The VAT refund concerns only new, unused goods meant for personal use. You have to take them with you when you leave the EU, and they must exit the EU no later than the last day of the third month after your purchase date.

For example, if you buy something in April, you must leave the EU with it by the last day of July.

Very important to know : all services (like restaurant meals, hotel stays, taxis, or guided tours) are not eligible for a VAT refund. Neither are consumables you’ve already used in France.

For the official rules, see the French Customs eligibility criteria (PABLO).

What purchases are included for a VAT refund in France?

A VAT refund is a smart way to make your shopping in France more affordable. The good news? Most goods are eligible. They typically include:

- Clothing and accessories The most refunded items by visitors. This includes shoes, belts, scarves, jewelry, and more.

- Perfumes and cosmetics France is known globally for its cosmetics and fragrances. Brands like Chanel, Dior, Lancôme, and Caudalie are all eligible if brought home unused.

- Electronics and tech Tablets, headphones, cameras, and other tech devices are eligible.

- Souvenirs and artisanal products Regional specialties, local crafts, and decorative items (like pottery, candles, or kitchenware) can be refunded. Food can be eligible for tax-free shopping, as long as it has not been consumed before leaving the EU. For example, you can get a VAT refund on a piece of cheese, provided it’s vacuum-sealed and unopened when you pass through customs.

- Wines and spirits (with caution) Good news, bottles of wine and spirits also qualify. Rules for liquids in carry-on luggage still apply, so check how you’ll be transporting them.

What purchases are excluded for a VAT refund in France ?

Before visualising your VAT refund, it’s worth checking two key points : whether you personally qualify, and whether your purchases are eligible.

Even if you meet the personal requirements, some items are excluded from VAT refunds due to their nature or legal status. These include :

- Cultural goods subject to export restrictions (such as national heritage artifacts).

- Products covered by the Washington Convention (e.g. those involving endangered species), narcotics, and similar regulated items.

- Manufactured tobacco.

- Vehicles or transport equipment for personal use, including trailers, motorcycles.

- Petroleum products, such as fuel and motor oil.

- Weapons.

Feel free to ask Zapptax support team if you're unsure whether your purchase is eligible. Some exclusions may surprise you, especially when it comes to specialized or regulated goods.

Step-by-step guide : how to get a VAT refund in France

Nowadays, there are two main ways to claim a VAT refund in France : the traditional one, available in only certain stores and a more flexible, and digital solution that lets you manage everything from your phone.

Take a look at our step-by-step guide that presents how each one works, and choose your best option !

Step 1 : Enjoy your shopping

Traditional way: You must shop in stores displaying the "Tax-Free Shopping" signs, and buy at least 100 € in the same store, on the same day. At the moment of purchase, tell the vendor you would like a tax refund.

First, they will check your passport to confirm you're eligible, so don’t forget it. Then comes the paperwork, the store has to manually prepare your tax-free form based on your purchase details. It’s not always fast, and during busy hours, you might end up waiting while the staff processes everything.

With an app like Zapptax : You’re free to shop anywhere in France, even in stores that don’t usually offer tax-free shopping. You can also order online and have your items delivered in France. To make your purchases eligible, just request an invoice made out to Zapptax. In-store, ask the seller for that invoice directly. For online purchases, enter Zapptax’s name and address at checkout. It’s that simple.

Step 2 : Centralize your invoices and get a tax-free-form

Traditional way : Each store will give you a separate paper tax-free form. You’ll need to manage multiple documents and make sure each is correctly filled out before heading to Customs.

With Zapptax : Instead of paper handling and waiting in store, the service allows you to upload your invoices directly in the app. It’s the fastest and the easiest way. First, you scan or photograph your invoices, then upload them, and so let the platform prepare and fill the tax-free-form for you.

Step 3 : Validate your tax refund form at Customs before departure

For both options : Before you leave the European Union, you must validate your tax-free form at Customs at the EU exit point. Your tax-free form is available in your app if you choose the digital options.

At most exit points in France (like Paris-Charles de Gaulle Airport or Orly, major train stations, sea ports and road border crossings), you’ll find PABLO terminals where you can scan the barcode on your form for validation. If there are no electronic terminals, a Customs agent will be able to validate your form electronically with a hand-device or by typing the number of your form in the system. Only in rare cases will the agent need to validate your form by stamping it manually.

It is imperative that you go to the dedicated tax-refund Customs desk for validation of your forms before checking in your luggage and before going through security. Make sure your items are easily accessible, as Customs agents can ask to see them. It’s best to plan this step in advance to avoid last-minute stress at the airport.

Step 4 : Submit the Validated Form and get a refund

With Zapptax, once your form is validated by Customs, there’s no extra paperwork. After a few weeks, you’ll receive your refund quickly and securely, with minimal steps and reduced fees.

- Electronic validation : you have nothing else to do -> your refund will be processed using your preferred payment method.

- Form validated by stamp : your refund will be processed after a picture of your stamped form is uploaded on the app.

Step 5 : Receive Your Refund

Refunds can be issued :

- Via bank transfer.

- To your credit card.

- By Paypal, Alipay.

To conclude, both the traditional and digital options allow you to claim a VAT refund. But in this increasingly administrative world, it is sure that digital solutions simplify the process, remove the store limitations, reduce paperwork, and also offer a better refund amount.

Frequently Asked Questions

1. How do I get a VAT refund in France?

To obtain a VAT refund, you must be a non-EU resident and spend at least 100 €. With the traditional way, you have to shop this amount in a single store on the same day. At the moment of purchase, request a “tax-free form” from the vendor.

On the other hand, if you're using a digital solution, you can shop freely in any store and online, and handle your tax-free forms directly through the app. You just have to request an invoice in Zapptax’s name when you shop. The minimum purchase amount of €100 must be reached across all your combined purchases during your stay.

2. What is the maximum VAT refund in France?

While the standard VAT rate in France is 20%, the actual refund amount is typically lower due to processing fees deducted by traditional refund operators. Tourists or business travelers using a tax refund app often benefit from a higher refund compared to traditional services.

3. What is the minimum amount required to get a VAT refund in France?

With digital solutions, you must spend at least €100 during your entire stay and this amount can be spread around several purchases.

In the traditional way, you must spend at least €100 (tax included) for each purchase, in the same shop and on the same day.

4. Do I get the full VAT refunded?

Sorry, not entirely.

First bear in mind that mathematically, you will never recover 20% of the amount you spent. That is because VAT is applied “on top” of the net price, which means that the VAT expressed as a percentage of the total price (VAT included) can be no more than 16,66% (Example: a good priced €100 before VAT will cost €120 VAT included. And the €20 of VAT represents only 16,66% of the full amount of €120).

Besides, tax refund providers usually deduct service fees, meaning travelers generally recover around 12% to 15% of the purchase price (VAT included). On average Zapptax refunds 85% of the VAT (corresponding to 14,2% of the total price), substantially more than what you are usually refunded.

5. Can I claim a VAT refund if I leave the EU from a different country than France?

Yes. You can validate your tax-free form at the customs office of any EU country from which you depart. Ensure that the form is stamped or electronically validated before leaving the EU.

If you shop in France but leave the EU from a different country, you will need to print your paper form and have it stamped by a Customs officer (as Pablo Kiosk are only available in France).

6. What is the PABLO system?

PABLO is an electronic system used in France to validate tax-free forms. Available at most French exit points (airports, train stations, sea ports, road border crossings…), PABLO terminals allow travelers to quickly scan the barcode on their forms for instant validation. Making the departure process faster and smoother.

7. What items are eligible for a VAT refund

Eligible items include most goods purchased for personal use, such as clothing, accessories, electronics, cosmetics, and souvenirs. Certain products like tobacco, weapons, vehicles, and petroleum products are excluded. You can find all the items details above in this article.

8. How long does it take to receive the VAT refund?

It depends on the provider and refund method. Usually it goes from a few days to a few weeks. Refunds are usually made via bank transfer, credit card, or PayPal.

9. What should I do if my tax-free form wasn't validated before leaving the EU?

If you couldn’t validate your form (due to a PABLO malfunction or the absence of Customs agents), you may be able to request a retroactive validation from French Customs. This process requires additional paperwork and isn’t always guaranteed, so it’s important to validate your form before departure whenever you can.

10. Is there a deadline to claim the VAT refund?

Yes. The tax refund form must be validated within three months of purchase. With Zapptax, there is no need to make a refund claim. It's automatic once your tax free form has been validated. *Zapptax is an online merchant and VAT refund application operating in France, Belgium, and Spain. For purchases made in France, your tax-free forms are issued through our trusted partner Triptax, a VAT refund operator authorized by the French tax authorities and certified by the French customs authorities.