VAT Refund France Calculator : estimate your tax-free savings

Travelers from outside the EU often assume they 'll get the full 20% VAT back on purchases in France, but the reality is more nuanced. Between intermediary fees, thresholds, and validation steps, the actual reimbursement is often around 10–15%. This complexity leaves many underestimating their refund or skipping the process altogether.

In this article, we’ll cover:

- how VAT and tax-free shopping work in France

- who’s eligible and what the minimum purchase is

- how to use a VAT refund France calculator

- worked examples to show real savings

Read on to learn how to easily estimate and maximize your VAT refund using a calculator and turn added tax into added savings !

Key points :

- You can get back part of the VAT paid in France as a non-EU tourist.

- Actual refund is 10–15% of the total price, due to how VAT is calculated and fees.

- Spend more than €100.01 to qualify for a VAT refund.

- Validate your tax-free form at customs before departure.

- Use our VAT refund calculator to see how much you can claim.

What is VAT and how does tax-free shopping work in France ?

VAT (“Value Added Tax” or “TVA” in French) is a consumption tax applied to goods and services included in the retail price.

That means when you buy something, you're automatically paying VAT, often without even realizing it.

The standard tax is 20%, which applies to the majority of consumer goods (clothing, electronics, perfumes...) and services.

France also applies reduced VAT rates for certain categories :

- 10% for restaurant meals, hotel accommodations, transport services, and some cultural events.

- 5.5% for essential goods such as most food products, books, medical equipment for disabled persons, and energy-efficient home improvements.

- 2.1% an even lower rate used for newspapers and specific medications reimbursed by social security.

For most travelers, the key point to remember is that you can claim a VAT refund on eligible purchases of goods (not services) if you're a resident outside the EU and meet certain conditions (we'll cover these below).

Non-EU tourists can claim back VAT on personal goods, provided :

- they’re aged 16+ and reside outside the EU

- your total spending during your trip is more than €100

- purchases leave the EU within three months and are validated by

Important note : The 20% VAT rate applies to the price excluding VAT. For instance, a product priced at €100 before tax will cost €120 with VAT. Here, the €20 VAT represents 16.66% of the VAT-included price (€20/€120).

Thus, even if all VAT were refunded, you’d recover at most 16.66% of the total price, not 20%. And since refund providers usually deduct fees, in reality, tourists recover around 10% to 15% of the VAT-included price.

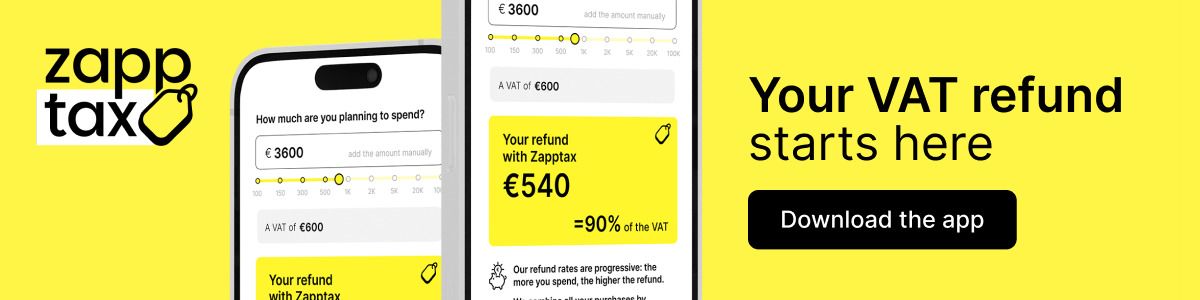

Why use our VAT Refund France calculator ?

- Visibility – immediately see estimated net refund after fees

- Planning – decide if your purchases qualify for tax-free status

- Transparency – measure impact of intermediary fees (10–30%) on your refund

How our VAT refund France calculator works

- Enter your total spending (TTC)

- We apply the standard VAT rate (20%)

- We estimate your refund

The refund rates are progressive : the more you spend, the higher the refund. We combine all your purchases in France to apply the best possible refund rate.

Example : For €1,200 spent at 20% VAT :

- VAT portion = €200

- Maximum recoverable = €200 (16.66% of TTC)

- Estimate refund ≈ €160 - 80% of the VAT

Example savings using the calculator

- €2,000 purchase :

- VAT = €333

- Estimated refund = €267 corresponding to 80% of the VAT

- €4,500 purchase:

- VAT = €750

- Estimated refund = €675 corresponding to 90% of the VAT

Use the Zapptax calculator to adapt to your actual spend and optimize accordingly.

Step-by-step guide to claim your VAT back

When making a purchase, just request "an invoice with VAT in the name of a Zapptax" and provide the relevant Zapptax billing details for France.

Importantly, stores are legally required to issue invoices upon request, and you are not obligated to justify why you're asking for one.

- Shop at your favorite stores or online during your trip. If you shop online, make your goods delivered anywhere in France.

- Ask for invoices made out to "Zapptax" (you’ll find exact details in the app).

- Upload your invoices directly into the app.

- Once your trip comes to an end and your total purchases reach at least €100 (VAT incl.), Zapptax generates your tax-free form.

- Before you leave the EU, validate your form at French Customs (via PABLO kiosk or a customs officer).

- Receive your refund within a few weeks.

Zapptax enhances your French shopping by giving you flexibility, simplicity, and maximum value, no matter where or how you shop.

Key benefits of using Zapptax

- Reach €100 across multiple shops during your stay : No need to spend €100 in one place. Combine invoices from different stores, online or offline.

- Works in all stores : From flagship stores to independent boutiques, as long as the retailer issues an invoice.

- Digital and seamless : No paperwork, no stress. Everything is managed in-app.

- Higher refunds : Receive up to 90% of your VAT, much higher than traditional intermediaries.

- Reliable and trusted : Over 150,000 travelers already rely on Zapptax for a secure and hassle-free VAT refund experience.

- No passport required at store : Identity verification is securely and officially completed once a year within the app, ensuring your data is protected.

- 24/7 multilingual support : Expert assistance is always just a message away.

Join over 150,000 travelers using Zapptax. Discover the app now.

Conclusion

With the right VAT refund solution, you can recover a significant portion of your spending, specially on high-ticket purchases ! Our VAT refund calculator demystifies the process and shows you exactly what to expect.

And by using Zapptax, you not only simplify the paperwork but also maximize your refund, up to 90% of the VAT. For all your purchases in France, fashion, tech, or gifts, turning tax into savings has never been easier !

FAQ

- How much VAT will I get back in France?

If all VAT were refunded, you’d recover at most 16.66% of the total price, not 20%. As the 20% VAT rate applies to the price excluding VAT. And since refund providers usually deduct fees, in reality, you will get back around 12% to 15% of the VAT-included price.

- How to calculate VAT refundable?

To calculate VAT refundable, use our calculator or this formula : VAT = Total TTC – (Total TTC / 1.20), then apply the refund rate (typically 70–90% of the VAT). At Zapptax, our refund rates are progressive : the more you spend, the higher the refund. We combine all your purchases by country to apply the best possible refund rate.

- How to get VAT refund leaving France?

To obtain a VAT refund, you must be a non-EU resident and spend at least 100 € during your entire stay. Use a digital solution like Zapptax, then you can shop freely in any store and online, and handle your tax-free forms directly through the app. You just have to request an invoice in Zapptax’s name when you shop. The minimum purchase amount of €100 must be reached across all your combined purchases during your stay. Before leaving the EU, validate your tax-free forms at a customs kiosk (PABLO) or officer.

- What are the conditions for VAT refund in France?

You must reside outside the EU, be aged 16 or over, stay under 6 months, spend at least €100.01 during your stay, and export the goods within 3 months.

- How much VAT do I claim back?

You claim back a portion of the 20% VAT included in your purchase. The refund is around 10–15% of the total price after fees.

- How much VAT can I reclaim in France?

Standard VAT is 20% on the pre-tax price, which translates to a maximum of 16.66% of the VAT-included amount. In practice, refunds average between 10% and 15% of the purchase price, depending on fees. Tourists or business travelers using a tax refund app often benefit from a higher refund compared to traditional services.

- Are all goods eligible for VAT refund?

No, exclusions apply, including : tobacco, cars, weapons, pharmaceuticals, and antiques.