The A to Z of tax-free shopping

VAT refund, Customs, tax-free shopping, refund rate... Are you still struggling with the tax-free shopping vocabulary? Well, not anymore! We created this handy resource full of must-know words that will ease your tax-free shopping experience.

VAT refund, Customs, tax-free shopping, refund rate... Are you still struggling with the tax-free shopping vocabulary? Well, not anymore! We created this handy resource full of must-know words that will ease your tax-free shopping experience.

PS: words are listed in alphabetical order.

Customs

Customs are checkpoints through which international travelers must pass before leaving a territory. They are located at the exit points (port, airport or any frontier) of a country.

When tax-free shopping, you MUST stop at Customs before leaving the EU in order to declare the export of the goods you bought in the EU to a destination — your country of residence — which is outside of the EU. Translation:

🇫🇷 Douanes

🇪🇸 Aduana

🇳🇱 Douane

Customs Validation

Customs validation (or tax-free form validation) is the last step of your tax-free shopping experience (before your refund). Before leaving the EU, you must validate your tax-free forms at Customs. This is the only way you can prove that the goods bought in the EU are about to be exported outside of the territory of the EU. Without going through Customs validation, you won’t be able to claim your VAT refund.

You will find all the necessary information to deal with Customs validation in Belgium, France and Spain in our dedicated articles.

Translation:

🇫🇷 Validation aux douanes

🇪🇸 Validación aduanera

🇳🇱 Douane validatie

Invoice

An invoice is a time-stamped commercial document that itemizes and records a transaction between a buyer and a seller. An invoice is different from a simple receipt or ticket, which only serves as a proof of payment.

When shopping (online or in store), you must ALWAYS ask for an invoice addressed at the name of Zapptax — a simple receipt or ticket is not enough. In order to be valid, an invoice must contain the following information:

- Zapptax name

- Zapptax address

- Zapptax VAT number (only for Spain and Belgium)

- Invoice number

- Date of purchase

- Identification of the store: name, address and VAT number in the country

- VAT rate that applies

- Description of each item

- Quantity of each item

- Price of each item

- Signature of the seller if the invoice is issued manually

Translation:

🇫🇷 Facture

🇪🇸 Factura

🇳🇱 Factuur

Minimum Purchase Threshold

This is the minimum amount you have to spend on your purchases in order to claim your VAT refund. It varies from country to country in the EU. This minimum is 100.01€ in France, 125.01€ in Belgium, and 0.00€ in Spain.

⚠️ Important notice: with the traditional tax-refund process, this minimum applies to each purchase (or to the total amount purchased within the same store). With ZappTax, the minimum only applies to your total purchases in a given country, no matter how much you spend on each purchase and in each shop.

Translation:

🇫🇷 Seuil minimum d’achat

🇪🇸 Umbral mínimo de compra

🇳🇱 Minimale aankoopdrempel

Non-EU Resident

A non-EU resident is any person who permanently lives in a country outside of the EU. Only non-EU residents are eligible for VAT refund in the EU. You will have to prove this by providing us with a copy of your passport. If you hold a passport of an EU country, you will also need to provide us with another document proving your residency (consulate card, resident permit, work permit, green card…).

Translation:

🇫🇷 Résident hors UE

🇪🇸 Residente fuera de la UE

🇳🇱 Niet-EU-ingezetene

Refund Rate

This is the rate at which tax-refund operators refund your VAT. Refund rate varies from operator to operator. It is usually expressed as a percentage of the total price you paid, VAT included. Alternatively, it can also be expressed as a percentage of the VAT amount. ZappTax has one of the highest refund rates on the market and refunds up to 15% of the total price you paid, VAT included (or up to 90% of the VAT amount), depending on the consolidated amount of your purchases.

NB: please note that with a VAT rate of 20%, the maximum that can be refunded, expressed as a percentage of the total purchase amount VAT included, is 16.66% (= 20 / 120) and not 20%. It cannot mathematically be higher than that! Translation:

🇫🇷 Résident hors UE

🇪🇸 Residente fuera de la UE

🇳🇱 Niet-EU-ingezetene

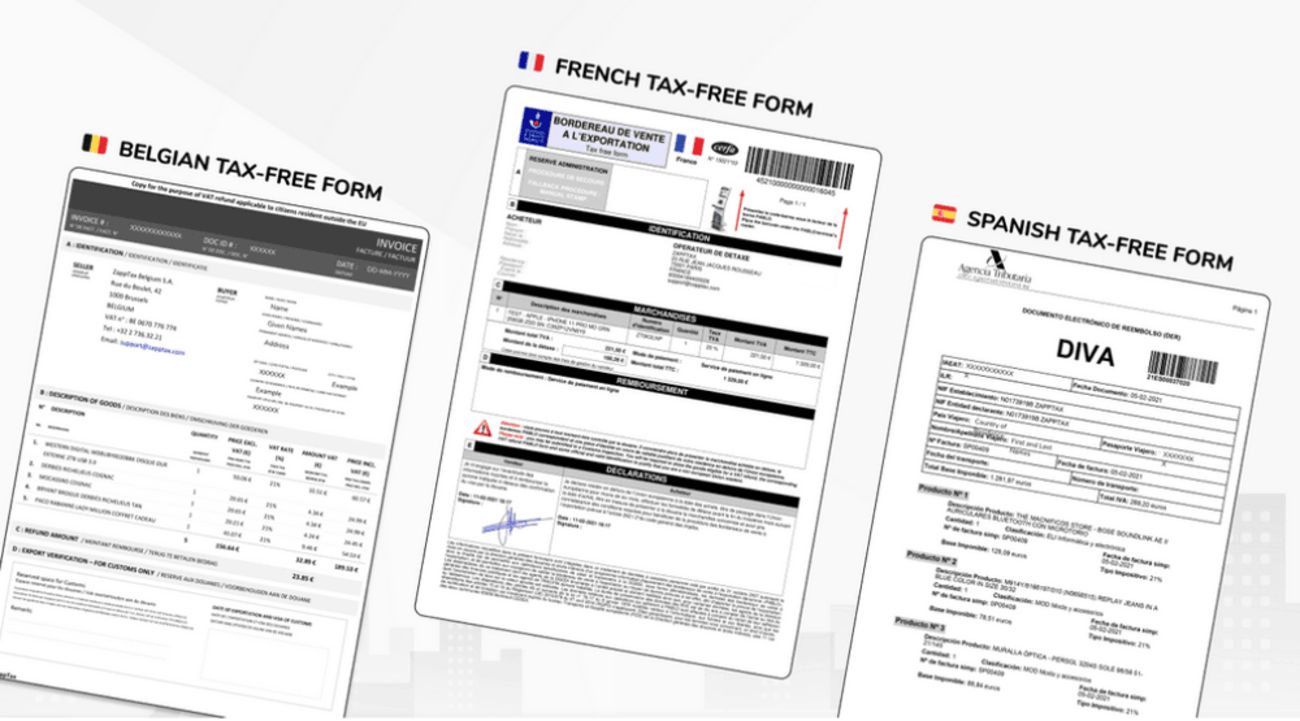

Tax-Free Form

A tax-free form is an official document — which can be delivered in printed or digital format — edited by either a merchant or a certified tax-refund operator and that lists the goods you want to claim a VAT refund on. Each tax-free form is unique and must be validated by Customs before leaving the EU.

Check out our complete guides on how to validate your tax-free form in Belgium, France, and Spain.

Translation:

🇫🇷 Bordereau de vente à l'exportation (BVE) or Bordereau de détaxe

🇪🇸 Formulario libre de impuestos

🇳🇱 Belastingvrij formulier

Tax-Refund Operator

A tax-refund operator is a company that helps you get your VAT back. Only official tax-refund operators can issue tax-free forms.

Translation:

🇫🇷 Opérateur de détaxe

🇪🇸 Operador de devolución de impuestos

🇳🇱 Operator voor belastingteruggave

Tax-Free Shopping

Tax-free shopping allows travelers who are residents outside of the EU to claim a refund of the VAT they paid on goods purchased in the EU when they carry these goods back in their personal luggage when they return to their country of residence.

Tax-free shopping is an EU-wide scheme available in all 26 EU countries.

When tax-free shopping in France, Belgium or Spain, do not forget to download the ZappTax app. We will be glad to help you get your VAT back in these countries.

Translation:

🇫🇷 Détaxe

🇪🇸 Compras libres de impuestos

🇳🇱 Belastingvrij winkelen

Value Added Tax (VAT)

The Value Added Tax (VAT) in the European Union applies more or less to all goods and services bought in the EU. Most of the time, the tax is already included in the final price of the goods. Goods which are sold for export to a destination outside of the EU are normally not subject to VAT.

That is why you can claim a refund of the VAT paid on goods you take back with you to your home country (provided you are a non-EU resident).

Translation:

🇫🇷 Taxe sur la valeur ajoutée (TVA)

🇪🇸 Impuesto al valor agregado

🇳🇱 Belasting over de toegevoegde waarde

Tax-free shopping comes with a set of rules and a specific terminology that make it sometimes hard to understand. Because of this complexity, many travelers just give up on their right to claim their VAT back. At ZappTax, we want to make tax-free shopping easy and hassle-free for all eligible travelers. And that starts by understanding the words and terms associated with the process.