Swiss residents: 3 good reasons to go tax-free shopping in France

It's a well-known fact that there's a significant price difference between France and Switzerland when it comes to shopping. Many Swiss residents cross the border regularly to shop in France. This is even more exciting because Swiss residents (as non-EU residents) can request a VAT refund on their purchases made in France.

Getting a VAT refund on purchases made in France used to be a bit complicated, which discouraged many shoppers from getting their refunds. In recent years, the VAT refund process has undergone a digital revolution, making the whole experience simpler and easier.

1. Shopping is cheaper in France than in Switzerland

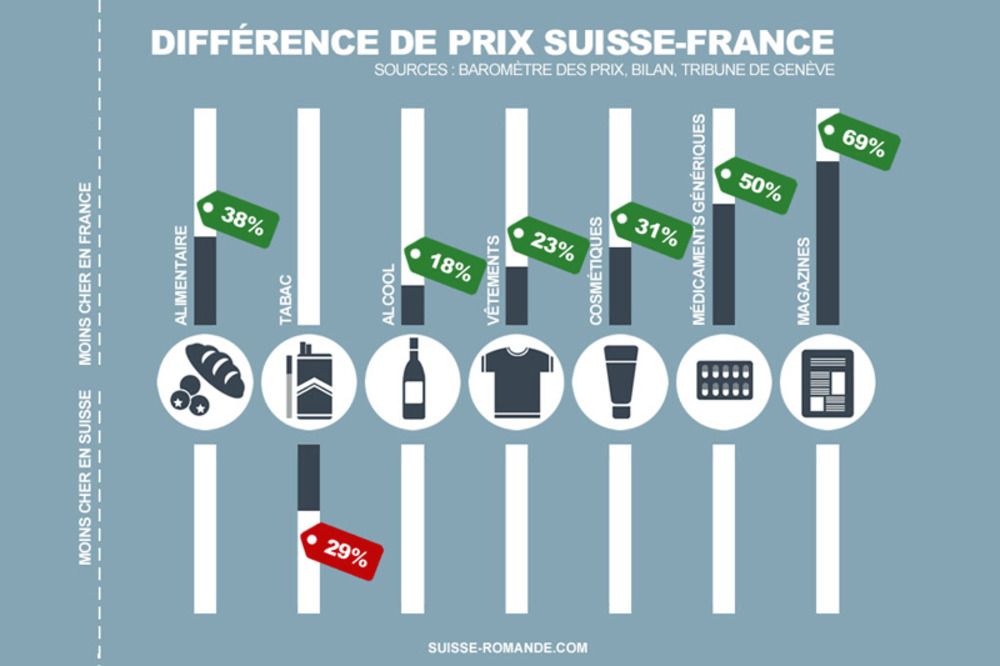

Most goods in France have lower prices (VAT included) than in Switzerland. For example, food, alcoholic beverages, cosmetic products, and clothing. As shown in the image below (by Swiss newspaper Tribune de Genève), food is on average 38% cheaper in France, alcohol 18%, clothing 23%, and cosmetics 31%. Generic drugs and magazines are strikingly cheaper by 50% and 69%, respectively.

Source: Suisse Romande

Getting a VAT refund on the already cheaper goods you buy in France is another good reason to shop in France rather than in Switzerland.

2. Simple VAT refund process

If you've given up on the idea of getting a refund because your previous experience was too cumbersome, then what we are about to tell you will change your mind!

In recent months, the French government has announced two important changes to simplify the VAT refund process:

-

Since December 5th, 2020, you can scan your tax-free form at self-service terminals (called PABLO kiosks) directly from your smartphone. If you are using the ZappTax app, it is therefore no longer required to print your tax-free form.

-

Since January 1st, 2021, the minimum purchase amount for tax-free shopping has decreased to €100.01 including tax (it previously stood at €175.01).

When you return to Switzerland, the standard VAT rate of 7.7% is applicable if your purchased goods are worth more than CHF 300 (around €270). Customs duty fees depend on the quantity and value of your purchased goods. Whether or not you have to pay the VAT and/or customs duties on your return to Switzerland, you can save up to 90% of French VAT by using the ZappTax app.

3. ZappTax and QuickZoll: the winning duo

ZappTax is for tax-free shopping in France

As a Swiss resident, the biggest advantage of using ZappTax in France is that you can shop tax-free in virtually ANY shops (including drugstores and food stores) in France.

Make sure you request from the seller an “invoice with VAT in the name of ZappTax” (and not a tax-free form). Also, ensure that the following information is provided on the invoice:

- Seller identification: name, address, and VAT number

- Invoice number and date of purchase

- Description of goods, quantity, and price

- VAT rate

Take pictures of the invoices you collected and upload them on the ZappTax app. ZappTax will combine all your invoices and send you one or multiple tax-free forms, which you must validate at Customs when leaving the EU.

Another big advantage of ZappTax is that there is no minimum purchase threshold of €100.01 per day and per store. What matters is that your total purchases during your stay in France are above this threshold.

VAT refund is now simple, fast, and efficient.

QuickZoll is for declaring your goods purchased abroad when you enter Switzerland

While Zapptax makes the VAT refund process easier in France, customs clearance in Switzerland is also streamlined if you use the Swiss government app called QuickZoll.

You can declare the quantity and value of the goods purchased in France directly on the QuickZoll app. When you arrive at the Swiss border, all you need to do is present a QR code to a Customs officer. Taxes and duties (if any) can directly be paid through the app. It's a great time saver!

If you want to know more about the VAT refund process or the ZappTax app, check out our websiteor visit our FAQ page Do not hesitate to contact us via email at support@zapptax.com or through chat for specific questions!