VAT rates in Europe 2021: Everything you must know

Value added tax (VAT), like any other tax, is a sensitive subject - and nobody enjoys paying it, right? - but it is required by the Government and we don’t have much to say about it. Unless…

What is VAT? Why does it exist? What are the different VAT rates in the EU? Who is eligible for a VAT refund? And how does it work? We are covering everything in depth in this article. Let’s dive into it!

What is VAT, why does it exist and who needs to pay it?

VAT (Value Added Tax) in the European Union applies more or less to all goods and services that are bought and sold for use or consumption in the European Union. Thus, goods which are sold for export are normally not subject to VAT.

Simply put, VAT is a consumption tax because it is charged on goods and services that people buy and it is also an indirect tax because it is collected by businesses on behalf of the Government. The bottom line is you pay VAT everywhere you go but there are exceptions!

All European countries have different VAT rates for different goods and services. Note that in this article, we’ll focus only on the goods.

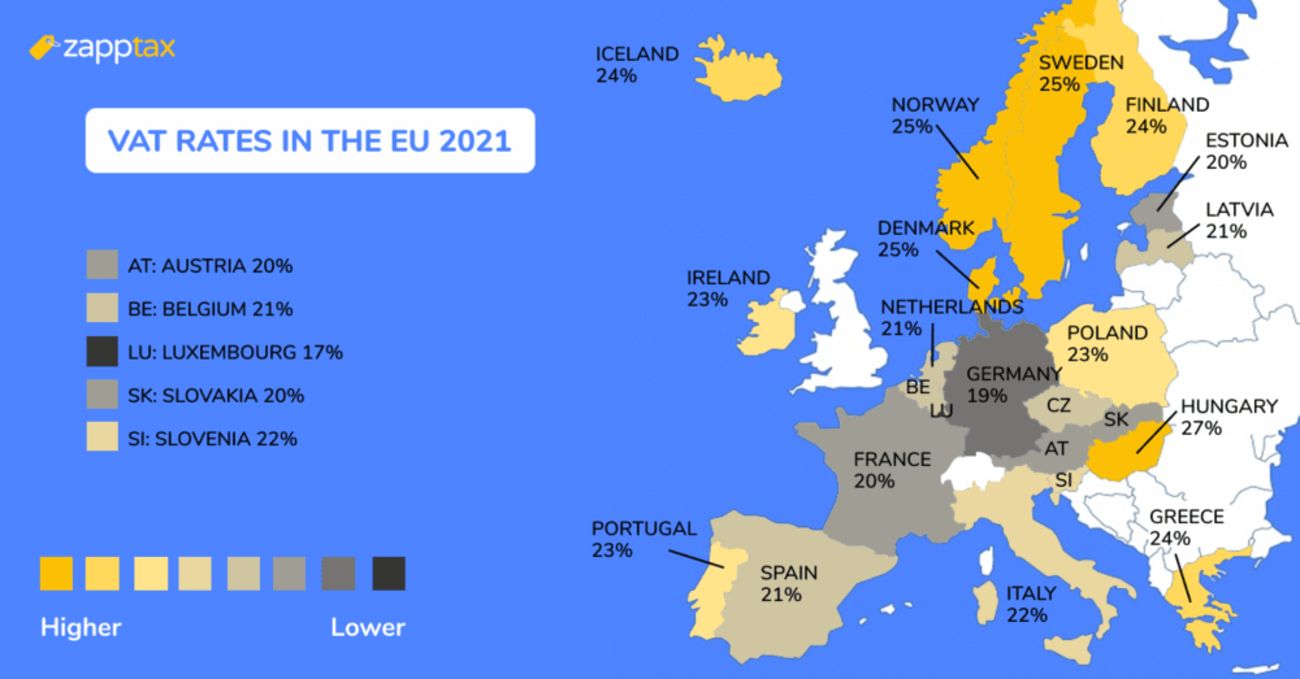

More than 140 countries worldwide, including all European Union countries, apply VAT on goods. Within the EU, there is an overall VAT architecture, but each country decides its rate independently. That is why VAT rates vary across EU countries.

VAT rate overview per EU country

EU countries have different VAT rates ranging from 17% to 27%. According to EU law, these countries are required to apply a standard VAT rate of at least 15% and a reduced rate of at least 5%.

Switzerland (a non-EU country) applies the lowest VAT rate of only 7.7% followed by Luxembourg (17%), Turkey (18%), and Germany (19%). Countries with the highest VAT rates include Hungary (27%), and Sweden, Norway, and Denmark (all at 25%).

Each country has (at least) two types of rates: a standard VAT rate and one - or several - reduced VAT rates. These reduced VAT rates usually apply to foods (except alcoholic beverages), some pharmaceutical products, medical equipment, books.

Here’s an overview of standard VAT rates in the EU in 2021 for your convenience.

Belgium

- Standard VAT rate: 21%

- Food and books: 6%

- Goods non-eligible for VAT refund: tobacco products

France

- Standard VAT rate: 20%

- Pharmaceutical products: 10%

- Food and books: 5.5%

- Goods non-eligible for VAT refund: tobacco products, some pharmaceutical products, cars, car parts, weapons

Spain

- Standard VAT rate: 21%

- Food: 10%

- Pharmaceutical products, medicines, books, magazines, some food: 4%

If this tax is included in the price of your products when you buy them, and if you are a non-EU resident, you may claim a refund of the VAT.

Are you eligible for a VAT refund?

As we have mentioned earlier, not everybody needs to pay the VAT on the goods purchased.

If you reside outside of the EU, you are considered a visitor and will be eligible for VAT refund on the goods you purchase in the EU, provided you bring them back with you in your personal luggage when you travel back home. This is called tax-free shopping. ️

Who is considered as a EU non-resident?

- Non-EU nationals traveling to the EU and whose permanent address (as stated in their passport or in any other official document) is not in the EU.

- EU nationals (i.e. EU passport holders) living outside the EU (who can prove this with a residence permit, consulate card, green card or similar document).

Important note:

- Only non-EU residents can get VAT back in the EU.

- The goods must be taken out of the EU within 3 months of their purchase.

- The goods must remain unused and in their original packaging.

- You must have supporting documents (invoices, tax-free forms, etc.) to claim your VAT refund.

How does VAT refund work?

To claim your VAT refund, you must follow these steps:

- Shop at any store and ask for an invoice in the name of ZappTax.

- Upload the invoices to the ZappTax app.

- Request your tax-free form through the app.

- Validate your tax-free form at Customs when leaving the EU.

- Receive your refund from ZappTax.

By following these steps, you can make the most of your shopping experience in Europe and enjoy significant savings through VAT refunds.

For more detailed information and assistance, visit our website or contact us at support@zapptax.com.